Payment Infrastructure: A Beacon of Hope After Fintech's Miserable Year

There is a massive divide between the requirements of the modern payment stack vs the current infrastructure. Yet this chasm presents a compelling opportunity for European fintech startups.

Let’s be honest. 2023 was not the year to be in fintech.

Venture investment last year into fintech, which a few years ago was the top sector for startup funding globally, amounted to $43 billion, its lowest level in six-years (according to Crunchbase)

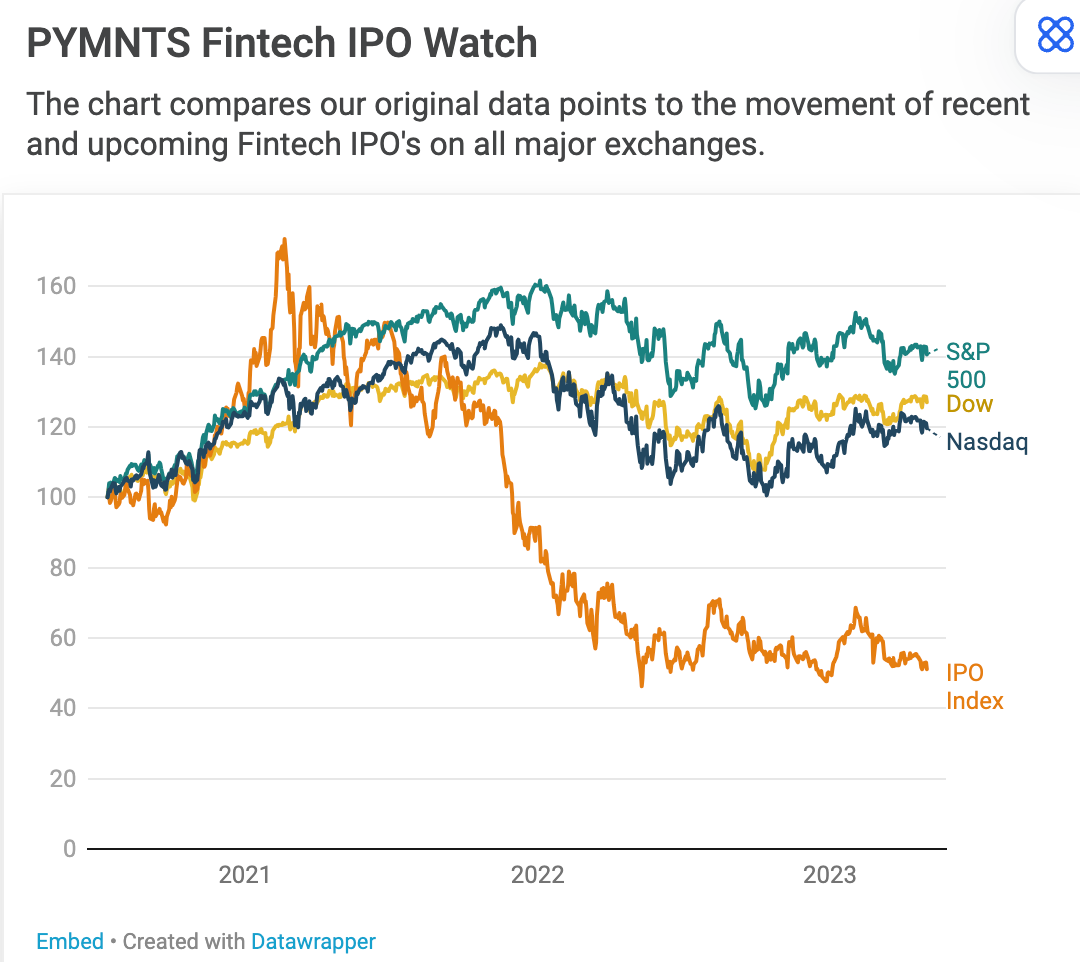

This apathy towards fintech in Venture was reflected in the public markets as well. The Pyments Fintech IPO (an index that monitors the performance of publicly traded fintech companies such as Affirm, Nuvei, and Robinhood), fell 68% from the highs of 2021 to May 2023.

Source: Pymnts.com

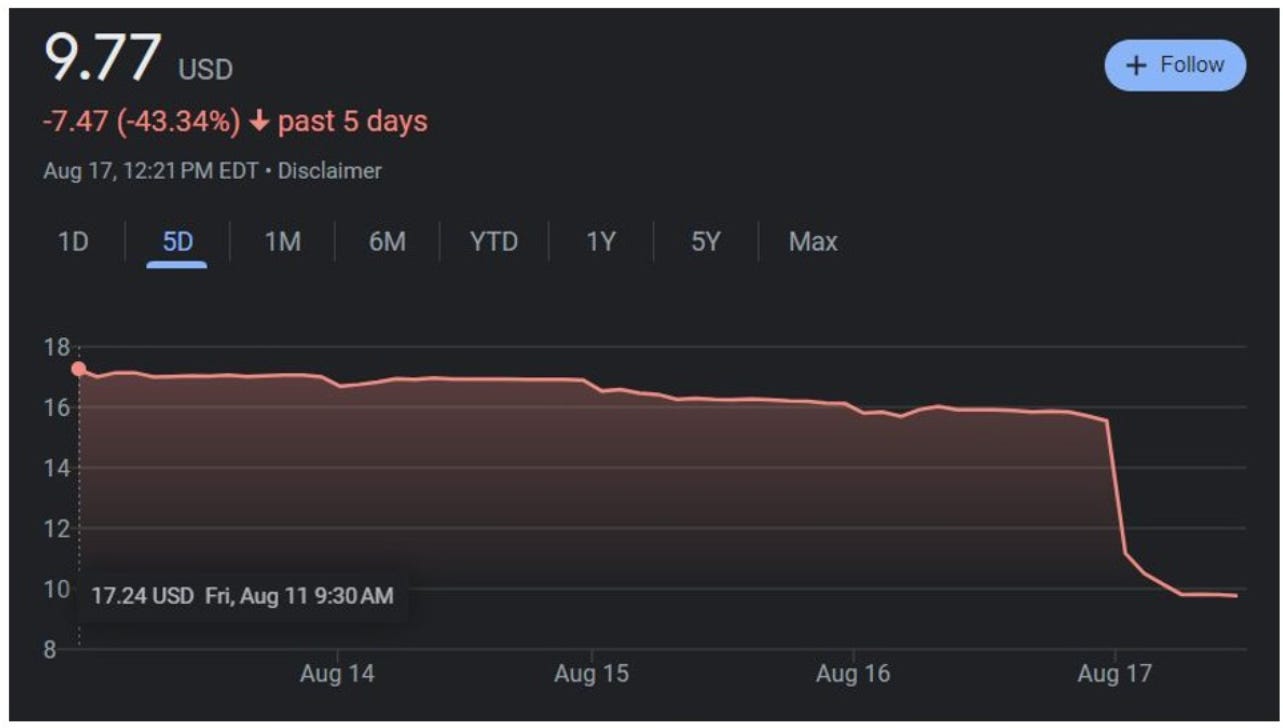

The pain continued in October when Worldline stock plummeted nearly 60 per cent after the payments group downgraded its sales outlook. Whist in August, Adyen lost more than 50 per cent in a day due to an earnings miss and worries about future growth, although later recovered towards the end of Q4 2023.

Source: Simon Taylor Brainfood.

But with the possibility of a Stripe and Klarna IPO in 2024, and major funding rounds for Sumup in December 2023, I believe that 2024 is going to be a big year for fintech.

This blog explores why there is a wealth of possibilities emerging within the payment infrastructure market for European founders and suggests there is much to look forward to in 2024 and beyond.

Cracks in the Monoliths

"Change is the law of life, and those who look only to the past or present are certain to miss the future." - John F. Kennedy

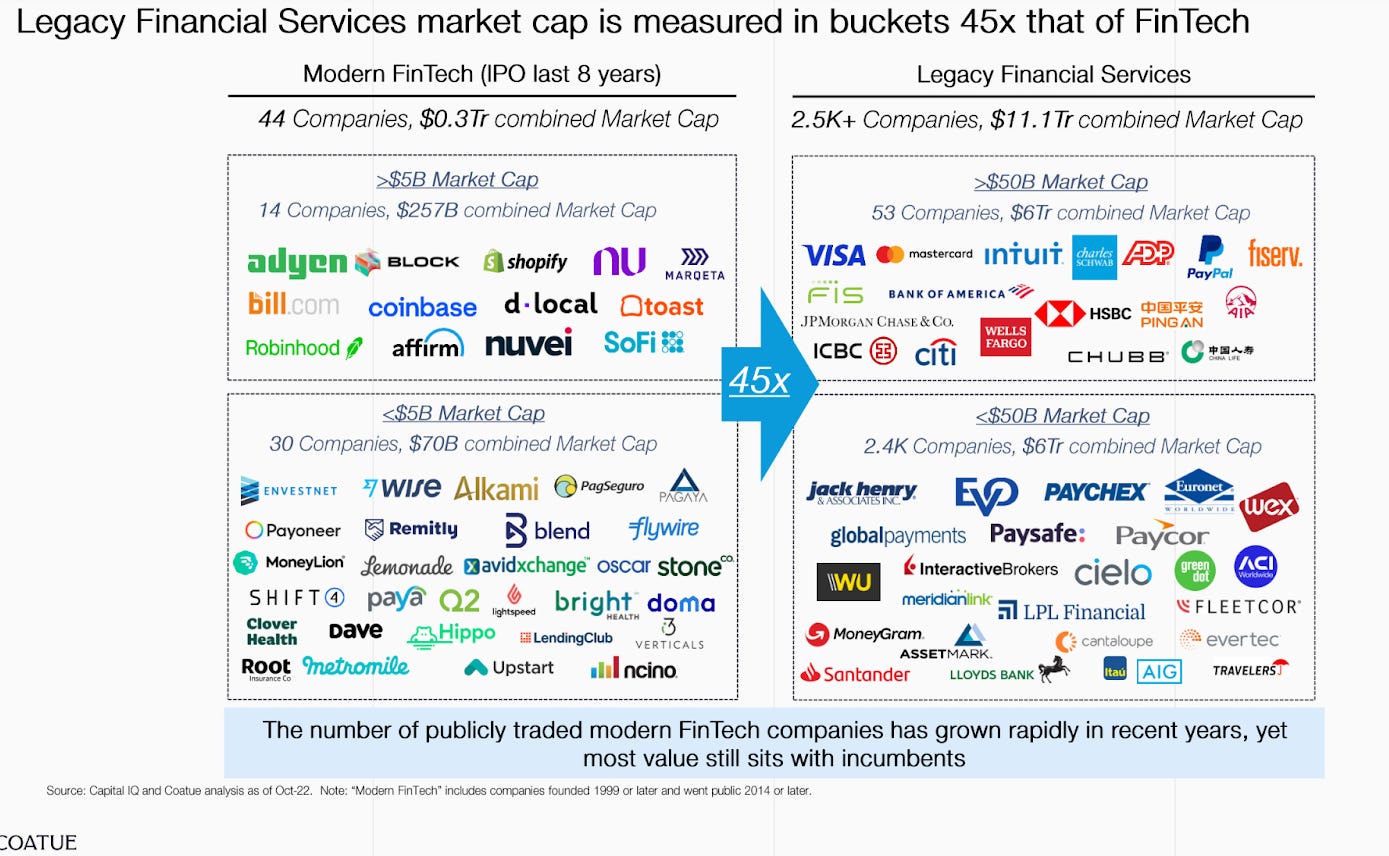

Payment infrastructure is one of the largest markets in the world, with incumbents holding a combined market cap of $11.1 trillion+.

Source: Coatue

Yet despite the ubiquity of Visa and Mastercard worldwide, banks’ payment and processing stacks rely on legacy systems at their core, between 30-50 years old. Written in archaic programming languages such as Cobol and TAL.

Many of the developers who originally built and maintained COBOL systems have retired or moved on to other industries. As a result, there is a shortage of developers with the necessary skills and knowledge to work with COBOL - Alex Dubov

Delving into the career pages of monolithic institutions such as Fiserv, FIS, Global Payments and Worldline, you can’t help but notice this disconcerting reality.

To make matters worse, instead of adopting modern infrastructure these institutions have historically adopted a Frankenstein acquisition strategy, by grafting on other payment processors. Creating a patchwork of inefficiencies. For example, Global Payments runs three legacy systems simultaneously - TYSY, Global Payments, and Heartland.

However, modern payment use cases demand data-driven functionality such as tokenisation, acquirer insights, acceptance of alternative payment methods (APMs) including Stablecoins and e-wallets, and enriched customer data sent alongside transactions.

The existing infrastructure is simply not equipped to support this shifting paradigm and lacks the adaptability to meet modern needs without significant investment.

Disrupting the status quo.

Payments have always been a begrudgingly accepted cost centre for merchants. Diners Club founded in 1950, was a pioneer of the payment network space, pre-dating Visa. They made money by charging merchants a 7% fee (Merchant Discount Rate) on each transaction, to cover fraud prevention costs. Something at the time, merchants were willing to pay for, given the increased footfall, customer loyalty and retention.

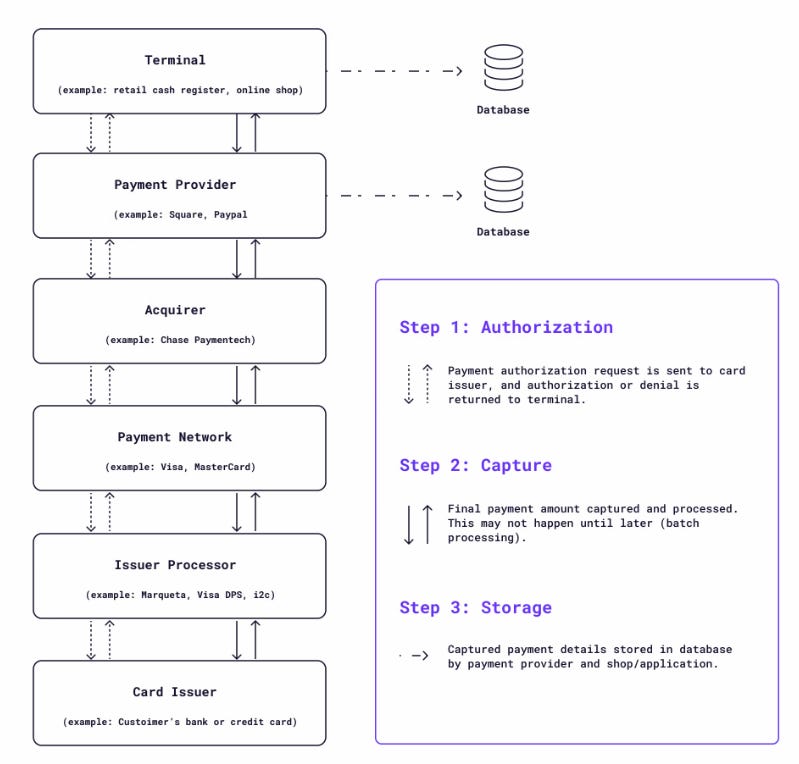

Since 1950, the modern payment stack has evolved into a tangled web of intermediaries with a complex fee structure:

Source: Cockroach labs

However, in recent times the age-old adage of payments being an accepted cost centre has been flipped on its head. By investing in the underlying acquiring and processing infrastructure, merchants can move further down the stack, bypassing legacy incumbents and monetising payments as a new revenue stream (through collecting their share of the interchange or payment processing fee). While controlling their customers’ transaction data.

Take the example of TikTok from Bytedance, which reportedly processes 260 billion in Gross Merchandise Volume (GMV) monthly1 and is embodying this transition of becoming a payment iconoclast. TikTok has demonstrated an ambition to move further down the stack to enable payments on the platform, partnering with JP Morgan for acquiring (since the cost of building their own acquiring or processing infrastructure would require 5+ years and a 9-figure investment for the full stack).

Booking.com has been rumoured to have gone one step further, moving away from the likes of Adyen as its acquirer and starting the process of gaining an acquiring license in its own right. You can see why monetising its payment flows as a revenue stream would be attractive, according to its latest annual report Booking processed a $51B TPV annual run rate (from Q4 22).

Since not every merchant has the financial firepower as Booking.com or Bytedance, many will choose to acquire solutions. Here in lies the opportunity for agile startups to provide an API-first, white-labelled, gateway, acquiring or processing infrastructure to merchants that choose not to build this infrastructure themselves.

In doing so, they arm traditional merchants with the ability to control (and monetise) their payment flows, as an alternative to outsourcing their payment stack to the established Payment Service Providers (PSPs) Checkout, Adyen or Stripe.

This concept does not only apply to merchants alone. The market also extends to marketplaces, vertical SaaS companies or bookings platforms, looking to embed payment infrastructure into their offering.

Early-stage European startups attacking this problem space include Silverflow2*, Norbr, June, Briklabs, Paytrix, Ztlment, FungPayments, and RyftPay

Beyond revenue into data.

"In the land of the blind, the one-eyed man is king” - Desiderius Erasmus

In the new world of commoditised access to open-source machine learning (ML) models that can be fine-tuned to a specific use case, the merchants with the most expansive proprietary customer data will rule supreme.

I believe payment data will play a crucial role in this digital transformation, but for now, accessing this data remains a challenge.

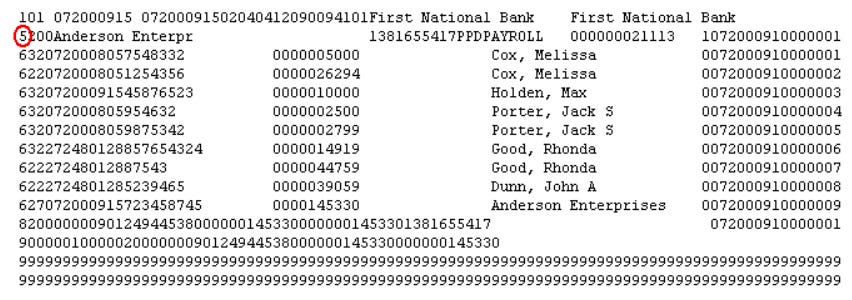

Currently, the payment switch is responsible for converting a transaction to the right message format (i.e., ISO8583, ISO20022) and routing the payment. However, these legacy payment switches such as Base24 by ACI worldwide which controls almost 75% of the market, are written in Transaction Application Language (TAL) on Tandem computers. This means they only work with predefined message formats and lengths and restrict the amount of data that can be shared on a per-transaction basis. Leaving merchants blind to potential customer insights.

For example ACH payments in the US, the NACHA format is composed of 94 character records, limiting the company discretionary data that can be shared on a per-transaction basis.

Source: Thompson Reuters

In the instances where the data is available, for example with Adyen clients, access is often expensive and data formats are rarely shared in a structured way digestible directly into customer data pipelines.

PSPs, Payfacs and processors are now being pushed to provide both customer and product data to merchants, such as purchase recency, frequency, monetary value, and geolocation.

As well as transaction data to acquirers such as interchange and network fee breakdowns. Industry pricing of interchange ++ is often a black box for acquirers, where lack of access to data causes miss-pricing and terminal margin contraction. This is particularly evident with long-tail SME customers, where acquirers struggle to price effectively across Card Present and 3DS transactions.

Herein lies a compelling opportunity for startups to leverage the data from PSPs to provide white-labelled AI fraud detection using ML models. The ability to profile customers in real time and provide transaction risk analysis is a compelling proposition for both merchants and PSPs. For example, making payments conditional on newly acquired datasets and workflows, thus reducing the operational time spent investigating authorised push payment fraud (“APP”), or chargebacks.

Another interesting use case surrounding transaction data is using ML models to predict a customer’s most likely preferred payment method (amongst the myriad of options or their probability of abandonment from their primary account number PAN, email address IP address or device ID. Thus driving conversion, providing personalised offerings and reducing cart abandonment.

European startups attacking this problem space include (Tunic.tech, Fero Payment Science, and Statement)

What is the end state for payment infrastructure?

Looking into the future, it is clear that managing payments between multiple parties and across different geographies has become so complex that the most resource-rich companies, such as Uber and Spotify, now employ payment teams of more than 100 people.

And this is for card and ACH payments…

How will this infrastructure cope with the imminent rise of Variable Recurring Payments (VRP), Account to Account (A2A), and Real-time Payments such as Faster Payment in the UK, PIX in Brazil and UPI in India? Let alone with the proliferation of the use of stablecoins as a payment rail to solve the correspondent banking problem in remittance.

The trouble is that historically incumbents perform poorly at recognising the need to modernise, as we know from Clayton Christensen's S-curve theory. In the past decade, legacy acquirers were slow to recognise the strategic threat of gateway acquirers and failed to incorporate a modern, single-supplier integrated end-to-end service.

Should history repeat itself with incumbents neglecting the pressing need to modernise, turning to startups - either through acquisition or partnership - might be the only recourse.

At Crane we remain very interested in payment infrastructure. If you are a founder building in the space please reach out to me on guy@crane.vc!

"It is not the strongest of the species that survives, nor the most intelligent that survives. It is the one that is the most adaptable to change” Charles Darwin.

(Simon Taylor Source)

*Crane Venture Partners portfolio company